More advisory board members will be added here soon.

Alison most recently held the role of chief financial officer of CrossFit for nearly three years, and she also served as interim chief executive officer and chief marketing officer during her tenure.

Throughout her career, Alison has held operational and investment roles at high-growth companies in the technology and consumer sectors. She has been a growth and venture capital investor for more than 15 years, previously working as managing director of Mercato Partners, and she currently serves as a venture partner with Signal Peak Ventures.

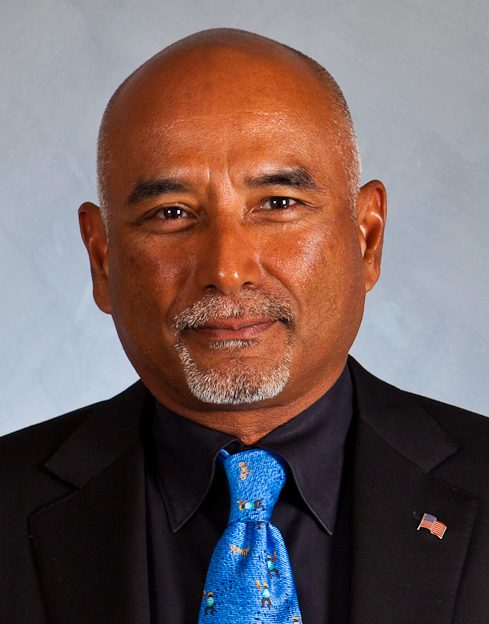

AJ is a results-driven operator and growth investor with 20+ years of global experience across a wide range of technology and tech-enabled services sectors and throughout the capital structure. Over the course of his career, AJ has led more than $50 million in equity and debt investments, supported in excess of $250 million of aggregate revenue growth as a board member/observer, and advised on M&A transactions and capital raises totaling more than $1 billion. As COO at Vertex, AJ oversees growth and operational excellence, including leadership of Vertex’s construction management agency and MSP services divisions.

AJ also is a venture partner with Unifi Ventures – where he serves on the boards of SHARE Mobility and KoreLock – and a chief experience officer with BRITE Energy Innovators. He previously was a partner with Iron Gate Capital, where he led multiple investments, including EGYM and Fetch Package. Prior to Iron Gate, AJ led the corporate venture capital and corporate development effort in North America for Delta Electronics and supported VC-backed entrepreneurs as a banker with Pacific Western Bank. He started his career in investment banking at Innovation Capital.

AJ is a passionate servant leader in the Rocky Mountain ecosystem and serves as co-chair of the Rocky Mountain Venture Capital Association. He previously served on advisory boards with the Wells Fargo/NREL Innovation Incubator (IN2) and Blackstone Entrepreneurs Network. AJ holds a BS degree in business administration from the University of Colorado Boulder and an MBA from the University of North Carolina at Chapel Hill’s Kenan-Flagler Business School. He lives in Denver with his wife and two daughters.

Josh is a senior industry principal at Workiva who helps lead its capital markets practice. Josh started his career with KPMG and served audit and advisory clients for nearly a decade, followed by a number of industry accounting and finance roles, such as controllerships and corporate development.

Josh has experience with multiple initial and secondary offerings, business combinations and mergers, financial statement audits, Sarbanes-Oxley Act audits and implementation, and systems integrations.

Grant is a managing director within KPMG’s technology, media and telecommunications investment banking group, specializing in the software sector. He is based in the Portland, Oregon, office.

Grant has more than 10 years of software investment banking experience, with a primary focus on M&A and growth equity capital raises. Grant received a BA in economics and finance from Claremont McKenna College and an MBA from the University of California, Berkeley, Haas School of Business.

Laura represents emerging growth companies and handles early- and late-stage venture capital, growth equity, private equity, and merger and acquisition transactions. She represents public and private company buyers and sellers in domestic and cross-border acquisition transactions – including options to buy, joint ventures and other complex transactions – across a broad range of industries, such as information technologies, financial technologies, software, life sciences, medical devices and consumer products. In addition, Laura was recognized by Chambers as a leading lawyer in Corporate/M&A – Colorado in 2024.

Matt has been a general partner at Pelion Venture Partners since 2021, after two years as an operating partner with the firm. Prior to joining Pelion, Matt was the founder of College Heights Partners, an M&A consulting firm focused on helping software companies maximize their exit opportunities. College Heights was the advisor for several Pelion exits, including SOASTA’s sale to Akamai Technologies and DataScience.com’s sale to Oracle.

Matt served for several years as senior vice president of corporate development at Oracle Corporation, where he was responsible for all of the company’s mergers and acquisitions, joint ventures, spinoffs, and technology licensing, as well as the $500 million Oracle Venture Fund.

Matt has been CEO for five venture-backed startups, including Pelion portfolio company Unifi Software (which later was sold to Dell). He is a frequent lecturer on topics relating to corporate strategy at colleges and universities, and he served on the board of a research laboratory at Cambridge University in the UK. Matt has been featured on CNN, Bloomberg TV and CNBC, as well as in The Wall Street Journal and BusinessWeek, on topics related to M&A and corporate strategy.

Erika is a Next Frontier Capital partner with experience investing across the life cycle of entrepreneurial companies. With roots in the Mountain West, Erika loves working with founders in the region she calls home.

Erika started her career on Sorenson Capital’s growth-stage team, supporting notable investments in Harness and Socure, as well as Amplitude’s initial public offering. Erika later spent time with Pelion and OpenView Partners investing in early-stage enterprise and vertical software as a service companies. Prior to her investment work, Erika managed a $300 million portfolio as a product manager and advised Fortune 500 software companies as a management consultant. She holds a bachelor’s degree in business management and a JD/MBA from Brigham Young University.

Erika is an outdoors enthusiast and often can be found hiking, mountain biking, or skiing in the backcountry. She is also an avid supporter of the performing arts and the biggest fan of her 11 nieces and nephews.

Ryan is the managing partner at Unifi Ventures, an investment firm that specializes in forming special purpose vehicles (SPVs) to facilitate investment by family offices, ultra-high-net-worth individuals and accredited investors in category-leading technology companies at the growth stage. He currently serves on the boards of Respondology, HZO, Liqid and RemoteLock.

Ryan is a prior chair of the Rocky Mountain Venture Capital Association and served on its board for a decade. He also is the founder of the Starfish Greathearts Foundation, which support thousands of orphaned and vulnerable children in South Africa. Earlier in his career, Ryan held several operating roles at Investec Asset Management (now called Ninety One) in South Africa and England. He holds an undergraduate degree from the University of Cape Town in South Africa, a graduate degree from Oxford University in the UK, and an MBA from the University of Texas at Austin. He lives in Boulder with his wife, Lauren, and their two children, Jace and Madelyn.

For the past 40 years, Ed has been an active technology entrepreneur and investor. He is also a limited partner in venture capital and private equity funds. His investment activity is primarily focused on seed and early-stage technology startups. He mentors founders and executive teams, focusing on realistic operating plans, credible business models, and compelling investment presentations.

Venture capital and private equity firms have engaged Ed to assist their portfolio companies, and his experience and effectiveness span early-stage (revenues up to $50 million) to mid-sized ($50 million to $300 million) companies. His work has encompassed turnarounds and streamlining operations, M&A, intellectual property sales, upgrading management teams, securing equity financing, and preparing companies for initial public offerings.

Ed also leverages his expertise as an active board member, permanent executive officer or strategic advisor. In 2007 and 2008, he provided on-site business mentoring to nuclear, biological, chemical and delivery scientists from the Iraqi regime to develop feasible business models to aid in the post-war reconstruction of the country.

Ed holds an MBA from the Daniels College of Business at the University of Denver, and he studied electrical and mechanical engineering at the University of Colorado.

Jared is a managing director in KPMG’s deal advisory practice and leads the advisory practice for the Salt Lake City office. He has 17+ years of experience providing services to public and private companies, regularly advising clients on M&A deals, initial public offerings and public company readiness, as well as accounting change services, technical accounting, Securities and Exchange Commission reporting matters, and internal controls.

Jared also leads several KPMG thought leadership initiatives within the deal advisory practice, encompassing projects related to capital markets, M&A, technical accounting, and overall learning and development programs for accounting advisory. He has presented on several M&A and capital market panels, including for the Nasdaq Entrepreneurial Center.

Bryan has 15+ years of experience providing audit and advisory services in the engineering and construction, financial services, technology, media, and telecommunications industries.

Between 2011 and 2013, Bryan completed a two-year secondment in Dublin, Ireland. He has extensive experience working with startup and high-growth companies, as well as large public companies clients leading complex, global and technical engagements.

investing in early- and growth-stage technology companies. Since 1992, Brian has worked extensively with early-stage tech companies and in venture capital finance as an attorney, investor and venture capitalist. Brian previously was a partner and chair of the corporate and securities group with Fairfield and Woods in Denver. He also worked on the patent, copyright and trademark subcommittee of the US Senate Judiciary Committee, and in corporate finance and accounting with Electronic Data Systems in the US and Europe.

Brian received his law degree, magna cum laude, in 1992 from the University of Arizona James E. Rogers College of Law, and a BS degree in business finance, magna cum laude, in 1988 from the University of Arizona.

Erika is an audit partner and the office managing partner for the KPMG Salt Lake City office, and she serves as the KPMG Private Enterprise practice leader for the Mountain region business unit. She previously led KPMG’s Boulder office for 10+ years. Erika has more than 24 years of experience advising public and privately held entities, including Securities Exchange Act of 1934 filings, initial and secondary registration statements, mergers and acquisitions, and debt offerings. Her primary areas of expertise range from audit services and initial public offering (IPO) readiness services to acquisitions including due diligence, technical accounting matters, and financial reporting.

Erika has significant familiarity serving private equity- and venture capital-backed companies, including taking them through an IPO. Her experience includes public company filings, including debt and equity, business combinations, and working with Securities and Exchange Commission (SEC) comment letters. She also has guided companies through technical accounting issues, such as revenue recognition, complex debt and equity agreements, sale leaseback transactions, share-based compensation, business combinations, and income taxes.